Insightful Waves

Exploring the currents of everyday news and insights.

Why Whole Life Insurance Might Be Your Best Kept Secret

Discover why whole life insurance could be the hidden gem in your financial plan—secure your future and unlock its benefits today!

The Hidden Benefits of Whole Life Insurance: Why It Might Be Your Best Kept Secret

Whole life insurance is often misunderstood, with many viewing it solely as a means of providing a death benefit. However, this policy offers a multitude of hidden benefits that can enhance your financial strategy. For instance, each premium payment contributes not only to your insurance coverage but also to a cash value component that grows over time. This cash value accumulates on a tax-deferred basis, allowing your savings to grow without the burden of immediate taxation. According to Investopedia, this aspect makes whole life insurance a valuable long-term investment vehicle as well.

Moreover, whole life insurance provides a unique opportunity for financial liquidity. Policyholders can borrow against their cash value for various needs—such as education expenses, home purchases, or even emergencies—often at favorable interest rates. This flexibility can help you manage unforeseen financial challenges while still maintaining your policy. Plus, the death benefit remains intact, ensuring your beneficiaries are cared for. As noted by NerdWallet, understanding these hidden benefits can truly position whole life insurance as one of your best-kept financial secrets.

Whole Life Insurance Explained: Is It the Secret Solution You’ve Been Missing?

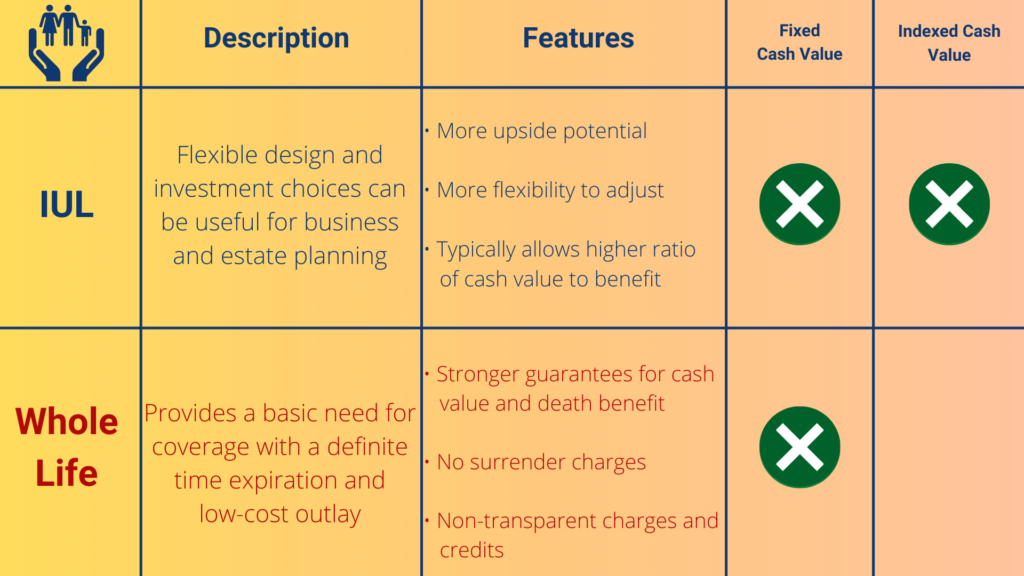

Whole life insurance is often touted as a comprehensive solution for those looking to secure their financial future. Unlike term life insurance, which provides coverage for a specified period, whole life insurance offers lifetime protection and a guaranteed cash value component. This means that a portion of your premiums goes toward building cash value, which can be accessed through loans or withdrawals, allowing policyholders to utilize their investment during their lifetime. For a deeper understanding of the benefits of whole life insurance, you can check out this Investopedia article.

However, it's important to weigh the pros and cons before committing to a whole life policy. While it provides lifelong coverage and can serve as a savings vehicle, the premium costs are significantly higher than those of term life insurance. Many financial experts argue that the initial investment can be overwhelming for some, potentially outweighing the long-term benefits. To explore different insurance options and determine what might be the best fit for you, consider visiting NerdWallet's guide on whole life insurance.

Top Reasons Whole Life Insurance Could Be the Smartest Investment You Ever Make

When considering long-term financial stability, whole life insurance stands out as an excellent investment choice. One of the core benefits is cash value accumulation. Unlike term life insurance, whole life policies build cash value over time, which can be borrowed against or withdrawn if needed. This can serve as a reliable financial resource during emergencies or opportunities, making it a versatile asset. According to Investopedia, 'policyholders can access the cash value of their whole life policies over time.' Moreover, this cash value grows at a guaranteed rate, providing a sense of security even when market conditions fluctuate.

Another compelling reason to consider whole life insurance is its potential for diversifying investment strategies. By including whole life insurance in your financial portfolio, you can mitigate risks associated with stock market volatility. Whole life policies often come with a dividend option, which allows policyholders to receive a portion of the insurance company's profits. This can enhance overall returns. As outlined by Forbes, this feature adds a layer of growth beyond the guaranteed cash value accumulation. Therefore, investing in whole life insurance not only provides a death benefit but also an avenue for steady wealth growth and financial peace of mind.