Insightful Waves

Exploring the currents of everyday news and insights.

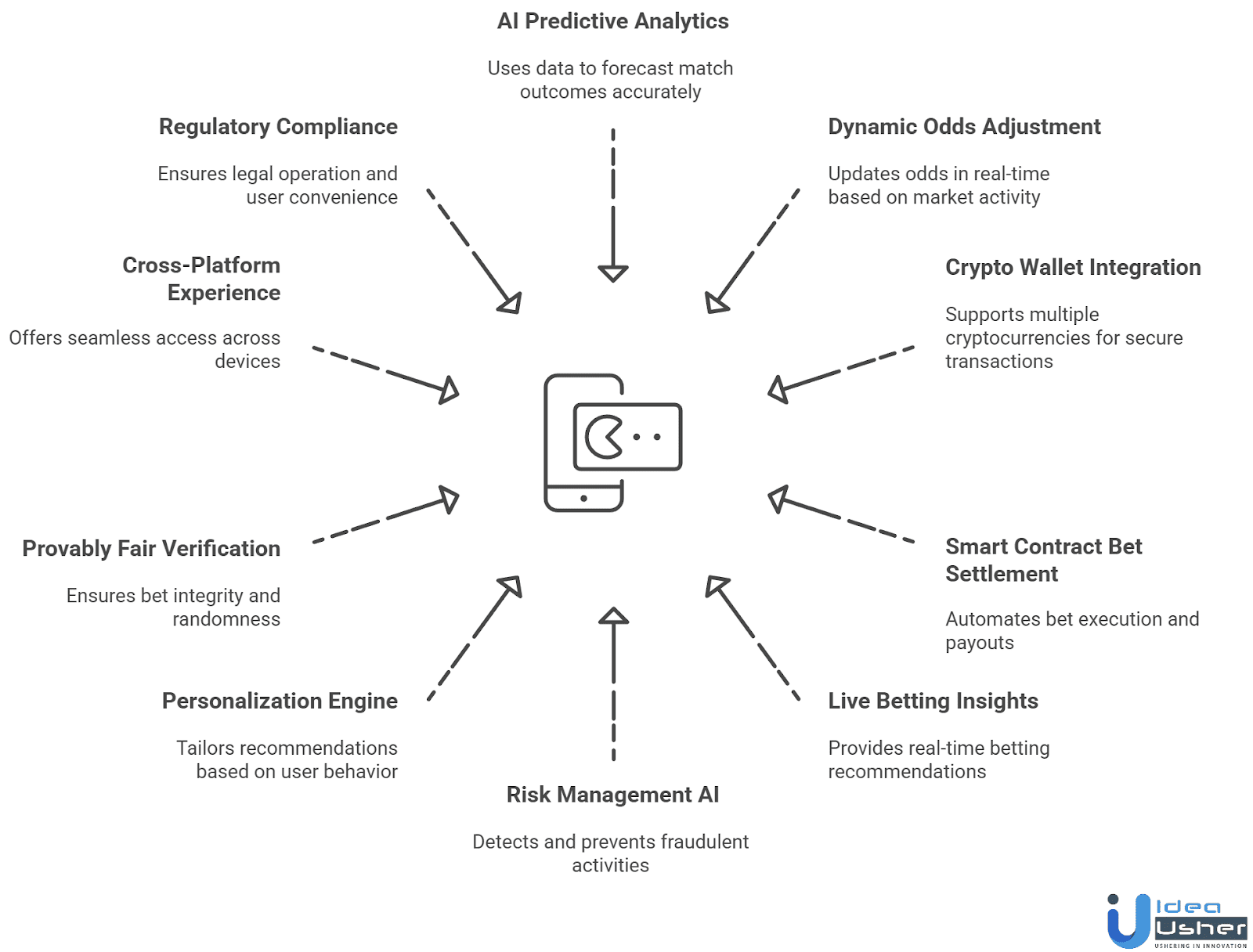

Betting on the Future: AI Meets Crypto in a Digital Arena

Explore the thrilling intersection of AI and crypto! Discover how they're shaping the future of online betting in our digital arena.

How AI is Transforming Crypto Trading Strategies

The emergence of AI technology has led to a significant shift in the landscape of crypto trading. Traditional trading strategies, which often relied on historical data and manual analysis, are being enhanced by sophisticated algorithms that can analyze vast amounts of data in real-time. These algorithms utilize machine learning to identify patterns and trends, enabling traders to make more informed decisions. For instance, AI can evaluate market sentiment by analyzing social media feeds and news articles, allowing traders to anticipate price movements before they occur.

Moreover, AI-powered trading bots are becoming increasingly popular among both retail and institutional investors. These bots execute trades automatically based on predefined criteria, significantly reducing the potential for human error and emotional bias. As traders embrace these advanced tools, crypto trading strategies are evolving. They now incorporate predictive analytics and risk assessment models, helping investors to maximize their returns while minimizing losses. The integration of AI in crypto trading not only enhances efficiency but also promotes a more strategic approach to investing in the highly volatile cryptocurrency market.

Counter Strike is a popular first-person shooter game that emphasizes teamwork and strategy. Players can engage in various game modes, including competitive matches where they can utilize a duel promo code to enhance their experience. The game features famous maps, customizable weapons, and a vibrant esports scene that attracts millions of fans worldwide.

The Role of Machine Learning in Predicting Cryptocurrency Trends

In recent years, machine learning has emerged as a powerful tool in the financial sector, particularly in the realm of cryptocurrency. By analyzing vast datasets, machine learning algorithms can identify patterns and trends that may not be immediately apparent to human analysts. These algorithms utilize various techniques, such as supervised learning and unsupervised learning, to classify data, make predictions, and refine their assessments over time. This capability is particularly beneficial given the volatile nature of the cryptocurrency market, allowing traders and investors to stay ahead of trends and make informed decisions based on predictive models.

Furthermore, the integration of machine learning in cryptocurrency trend prediction involves the use of various data sources, including price history, trading volume, and market sentiment extracted from social media platforms. By employing natural language processing (NLP) techniques, these systems can gauge investor sentiment and predict potential market movements. As the technology continues to evolve, the accuracy of these predictive models is expected to improve, allowing for more sophisticated investment strategies and enhancing the overall efficiency of the cryptocurrency market.

Are AI-Driven Betting Models the Future of Crypto Investments?

The rise of cryptocurrency has transformed the financial landscape, and now the integration of AI-driven betting models is generating significant interest among investors. These sophisticated algorithms leverage massive datasets and machine learning techniques to analyze market trends, predict price movements, and develop predictive models that can outperform traditional investment strategies. As digital currencies become more volatile and complex, the need for adaptive, data-centric approaches is paramount. This convergence of AI technology and crypto investment could pave the way for more strategic decision-making and risk management, making it an enticing prospect for forward-thinking investors.

Moreover, the potential for AI-driven models to continuously learn and adapt to changing market conditions makes them particularly valuable in the fast-paced world of cryptocurrency. Unlike human traders, these algorithms can analyze real-time data and execute trades at lightning speed, reducing the emotional biases often seen in traditional trading. As we look toward the future, it is evident that the ability to harness artificial intelligence in crypto investments could redefine how we approach financial opportunities. Investors who are willing to embrace this technological shift may find themselves at the forefront of a new era in the investment landscape.